capital gains tax increase effective date

In short we dont yet know the answer to this important question. 9 and racing against a Sept.

What Is The Stepped Up Basis And Why Does The Biden Administration Want To Eliminate It

The effective date would be retroactive to April 28 2021 the date President Biden first unveiled his proposals.

. A prospective effective date does two things. It is expected that the long-term capital gains tax rate change will be effective the day it is agreed to and announced with little to no advance warning. For individuals and businesses considering tax planning a key issue is the effective date of any tax increase or change to the deduction scheme.

Effective Date Considerations May 14 2021. June 9 2021 Bernie Kent JD CPA PFS It appears that the White House is planning to make the effective date for its proposed tax increase on long-term capital gains retroactive. The effective date for this increase would be September 13 2021.

Bidens Capital Gains Proposal. The top rate would be 288 when combined with a 38 surtax on net investment income. As part of the tax proposals announced by the Minister of Finance in the 2012 budget review capital gains tax rates will be increased.

The new rate would apply to gains realized after Sep. In 2022 it would kick in for single filers with. The proposal would increase the maximum stated capital gain rate from 20 to 25.

Proposed effective dates on the capital-gains. The effective date would be retroactive to April 28 2021 the date President Biden first unveiled his proposals. The bill falls apart and there is no capital gains rate increase at all success on the bill is far from guaranteed.

In the Tax Reform Act of 1986 enacted October 22 1986 the tax rate on long-term capital. An immediate effective date would. Which leads to the oft-asked question of when.

National Treasury hereby releases for public comment proposals relating to how these increased capital. 9 and racing against a Sept. The Presidents plan you may recall would make the increased capital gains rate effective after April 2021.

WASHINGTON -- President Bidens expected 6 trillion budget assumes that his proposed capital-gains tax rate increase took effect in late April meaning that it would already be too late for high. More than five months ago. 1 2022 but certain provisions may have proposed effective dates tied to committee action or the date of enactment for example capital gains tax rate increases may be proposed to apply to sales occurring after the date of committee action in early October or the date of.

1 2022 or later this is certainly possible. But this week John Gimigliano Carol Kulish and Tom Stou t try exploring the options and policy considerations for different capital gains effective dates. The effective dates of the newly enacted provisions generally are expected to be Jan.

If the capital gains tax rate were to increase to 396 prior to the date of sale the sale price would have to increase by 32to 132 millionto net the same 8 million after tax. Democrats make the change effective back to April or May though this seems very unlikely. This proposal would be effective for gains required to be recognized after the date of announcement.

Which leads to the oft-asked question of when. There have been two major increases in the tax rate applicable to long-term capital gains in the past 50 years. It avoids uncertainty for taxpayers and raises more tax dollars at least in the short run.

This may be why the White House is seeking an April 2021 effective date for the retroactive capital gains tax increase as President Biden announced the proposal on April 28 2021 although it was not widely publicized at the time and investors are still becoming aware of it. Biden formally unveiled the capital-gains rate hike and other tax hikes geared toward top earners on April 28 while addressing members of Congress. Effective date of increased capital gains tax rates for long-term insurers and related matters.

Democrats compromise on a prospective effective date of Jan. President Biden has proposed a substan tial increase in the capital gains rate. The Green Book indicated the capital gain hike would be effective for gains required to be recognized after the date of announcement Secretary Yellen intimated that date would be April 28.

Catching Up on Capitol Hill Episode 13-2021 President Biden has proposed a substantial increase in the capital gains rate. The current estimate of that effective date ranges from October 15 2021 on the early end. The effective date for this increase would be September 13 2021.

Democrats have made an increase in the capital gains rate a major priority in their upcoming reconciliation tax bill and the potential effective date is critical for many investment decisions. Details of the tax rate changes This resulted in a 60 increase in the capital. This resulted in a 60.

In short we dont yet know the answer to this important question. 1 2022 except for the proposed increase in capital gains tax rates which would likely be effective retroactive to April 28 2021. The House bill would apply the increase to gain recognized after September 13 2021.

The Green Book says this.

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca

Capital Gains Yield Cgy Formula Calculation Example And Guide

Capital Gains Tax Reporting And Record Keeping Low Incomes Tax Reform Group

/SchedD-59e44eca73a940459e36066f830ebf63.jpg)

Schedule D Capital Gains And Losses Definition

Canada Crypto Tax The Ultimate 2022 Guide Koinly

How To Calculate Capital Gains Tax H R Block

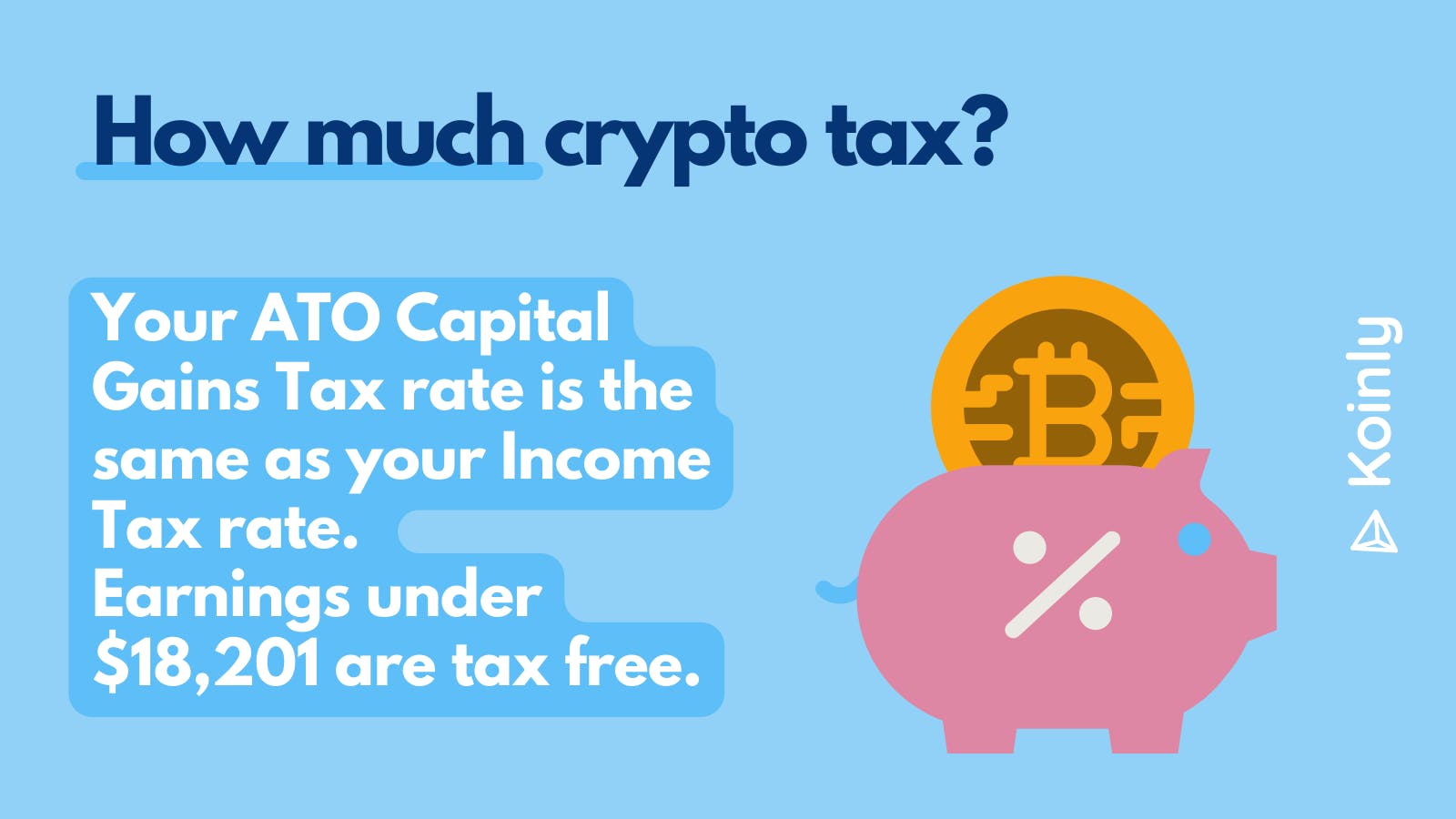

Your Ultimate Australia Crypto Tax Guide 2022 Koinly

How To Save Capital Gains Tax On Property Sale 99acres

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca

Capital Gains Tax What Is It When Do You Pay It

Canada Crypto Tax The Ultimate 2022 Guide Koinly

Your Ultimate Australia Crypto Tax Guide 2022 Koinly

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca

/SchedD-59e44eca73a940459e36066f830ebf63.jpg)

Schedule D Capital Gains And Losses Definition

Mutual Fund Investing Common Questions About Taxes In Non Registered Accounts