louisiana estate tax rate

It is indexed for inflation and for deaths occurring in calendar year 2020 the exempt amount is 1158 million for an individual and twice that for a married couple. Based on latest data from the US Census Bureau.

Louisiana Inheritance Laws What You Should Know Smartasset

Your 2021 tax rate is.

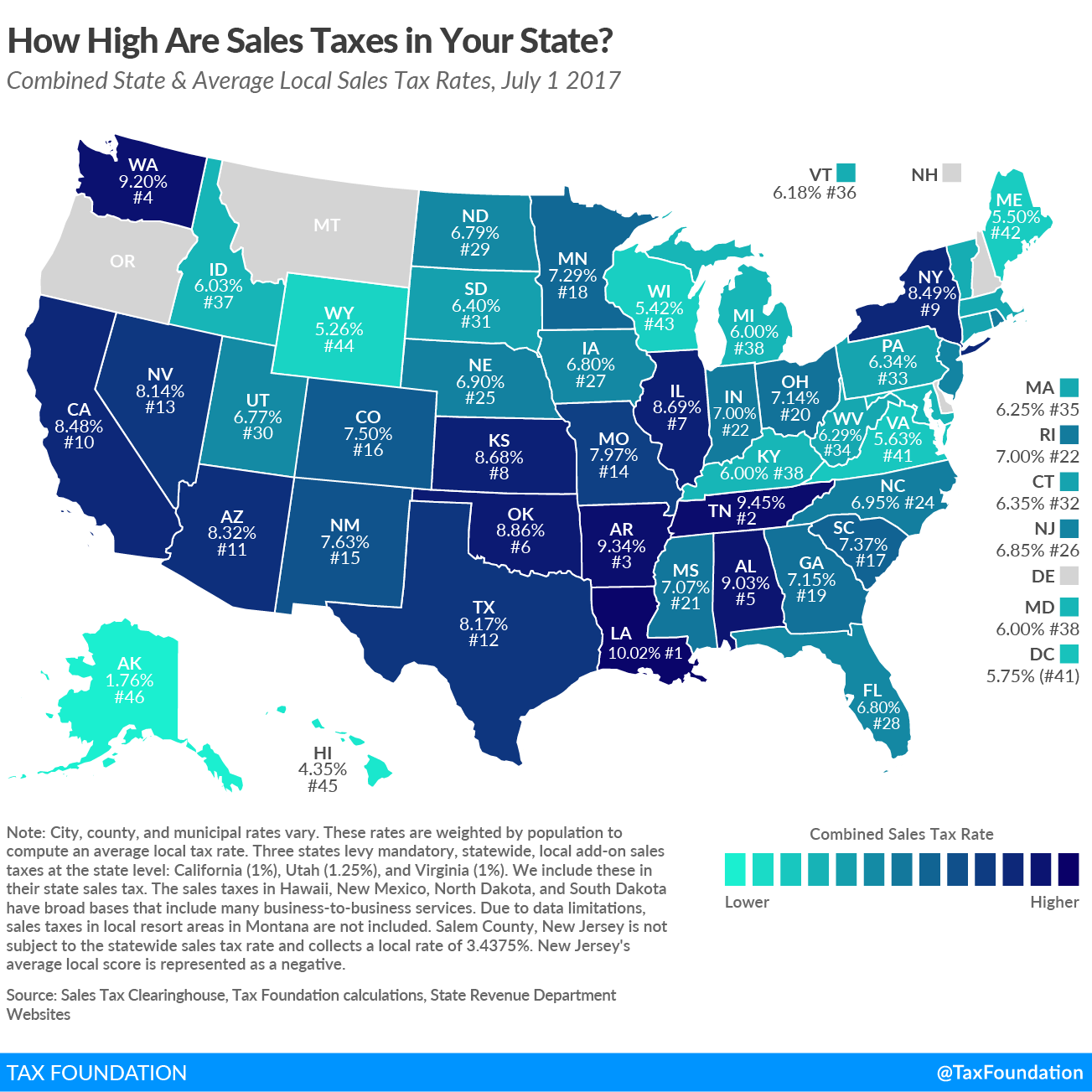

. The property tax rates listed below are the average for properties in Louisiana. Louisiana has a 445 percent state sales tax rate a max local sales tax rate of 700 percent and an average combined state and local sales tax rate of 955 percent. Compared to the nationwide 107 average effective property tax rate Louisiana has a generous rate at 053.

Louisiana has some of the lowest property tax rates in the US as only Alabama and Hawaii residents pay less on average than residents of the Pelican State. Three parishes in metro New Orleans were in the Top 10 with the highest property tax rates among Louisianas 64 parishes according to the Louisiana Tax Commissions annual report for 2017. It really should not be much of a surprise.

Louisiana has one of the lowest median property tax rates in the United States with only states collecting a lower median property tax than Louisiana. From Fisher Investments 40 years managing money and helping thousands of families. There are a total of 263 local tax jurisdictions across the state collecting an average local tax of 5076.

Such estates or trusts may elect to be taxed at the rate of five percent on total gross income from Louisiana sources. Yes Louisiana State Website. Louisiana has state sales tax of 445 and allows local governments to collect a local option sales tax of up to 7.

People still strive to lower their property taxes as. Ad The Leading Online Publisher of National and State-specific Probate Legal Documents. On average a homeowner pays 505 for every 1000 in home value in property taxes with the average Louisiana property tax bill adding up to 832.

Use this Louisiana property tax calculator to estimate your annual property tax payment. December 18 2018 505 PM. There is no estate tax in Louisiana but residents of the Bayou State may still have to pay the federal estate tax if.

Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. Average Sales Tax With Local. Federal Estate Tax.

Effective Real-Estate Tax Rate. Gift tax inheritance tax. Regenerated Max Mill Reports from 2005-2009 for all parishes except Orleans and Regenerated Max Mill Reports from 2006-2010 for Orleans Parish reflect the data in the current 2010 millage record in the columns entitled Purp - Roll Up.

Louisiana also has a corporate income tax that ranges from 350 percent to 750 percent. The top inheritance tax rate is 10 percent no exemption threshold Massachusetts. Tammany the next highest in the metro area at 1468 mills followed by St.

The data in the last three. Tax amount varies by county. Actual property taxes may vary depending on local.

You have chosen. The top estate tax rate is 16 percent exemption. In the case of immovable property which has been sold at tax sale the tax debtor.

Returns and payments are due on May 15th of each year on the preceding years income or on the 15th day of the fifth month after the close of the taxpayers fiscal period. 6 on taxable income of 50001 and above. The calculator will automatically apply local tax rates when known or give you the ability to enter your own rate.

Louisiana state allows a deduction up to 75000 for most homeowners. Learn all about Louisiana real estate tax. Because it is so high make sure to reduce your net assets as low as possible to minimize any estate tax liability.

Orleans Parish topped the list with a millage rate of 1541 with St. Median Income In Louisiana. 50000 60.

Most states with no estate tax have no gift tax either. The estate tax rate at the federal level is 40. If youre married filing taxes jointly theres a tax rate of 2 from 0 to 25000.

However because of the varying tax rates between taxing districts the average tax bill fluctuates from parish to parish. If the taxes remain unpaid the taxable property will be sold by the tax collector at a tax sale. Though Louisiana wont be charging you any estate tax the federal government may.

Louisiana also does not have an inheritance or gift tax. Louisiana has a graduated individual income tax with rates ranging from 185 percent to 425 percent. 4 on taxable income between 12501 and 50000.

Is Personal Property Taxable. The portion of the state death tax credit allowable to Louisiana that exceeds the inheritance tax due is the state estate transfer tax. 2 on the first 12500 of taxable income.

Whether you are already a resident or just considering moving to Louisiana to live or invest in real estate estimate local property tax rates and learn how real estate tax works. The average annual tax on property in the Pelican State is around 795 significantly less than in Connecticut New York or New Jersey. You can look up your recent appraisal by filling out the form below.

December 31 st and if not timely paid the amount will bear interest at a rate of 1 per month until paid. This means a couple can protect up to 2412 million when both spouses die for 2022 deaths. Ad Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios.

Under the federal estate tax law there is a credit for state death taxes. Estimate your Louisiana Property Taxes. Your 2022 tax rate will be.

The top estate tax rate is 12 percent exemption threshold. Louisiana has completely eliminated taxes on any inheritance but for estates that are large enough to require a federal estate tax return there is a Louisiana Estate Transfer Tax. Louisiana Department of Revenue.

The median property tax in Louisiana is 24300 per year based on a median home value of and a median effective property tax rate of 018. Average Property Tax Rate in Louisiana. The Economic Growth and Tax Relief Reconciliation Act of 2001 phased out the state estate tax credit between 2002 and 2005 and replaced the credit with a deduction for state estate taxes for deaths that occur.

Louisianas median income is 54216 per year so the median yearly property tax paid by. In Louisiana theres a tax rate of 2 on the first 0 to 12500 of income for single or married filing taxes separately. The exemption is portable for married couples.

The federal estate tax exemption was 1170 million in 2021 and increased to 1206 in 2022. The top estate tax rate is 16 percent exemption threshold. According to the Business Insider reports Louisiana belongs to the states with the lowest property tax rate.

The median property tax in Louisiana is 24300 per year018 of a propertys assesed fair market value as property tax per year. Louisiana Property Taxes Range. No estate tax or inheritance tax.

Louisiana has some of the lowest property tax rates in the US as only Alabama and Hawaii residents pay less on average than residents of the Pelican State.

Louisiana Ranks Favorably In New Property Tax Analysis Biz New Orleans

Louisiana Property Tax Calculator Smartasset

Louisiana Inheritance Tax Estate Tax And Gift Tax

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Louisiana Sales Tax Small Business Guide Truic

Louisiana Estate Tax Everything You Need To Know Smartasset

Where S My Refund Louisiana H R Block

Louisiana Estate Tax Everything You Need To Know Smartasset

Sold In 2022 Getting Things Done Country House We Got It

Louisiana Sales Tax Rate Remains Highest In The U S Legislature Theadvocate Com

Louisiana Estate Tax Everything You Need To Know Smartasset

Are There Any States With No Property Tax In 2020 Free Investor Guide Property Tax Indiana State States

Historical Louisiana Tax Policy Information Ballotpedia

Louisiana Property Tax Calculator Smartasset

Louisiana Retirement Taxes And Economic Factors To Consider

Estate Taxes New Orleans Orleans Parish Louisiana Lawyer Attorney Law Firm

Louisiana State 2022 Taxes Forbes Advisor