pa local services tax refund application

What should the employee do. This application for a refund of the Local Services Tax must be signed and dated.

Do You Need To File A Tax Return In 2018

LOCAL SERVICES TAX EXEMPTION REFUND APPLICATION _____ Tax Year A copy of this application for an exemption or refund of the.

. February 22 2022 Harrisburg PA There are more than 118000 low-income Pennsylvanians who may be missing out on state tax refunds of 100 or more the Department of. Make refund payable and mail to the applicant checked below. LOCAL SERVICES TAX - REFUND APPLICATION Tax Year APPLICATION FOR REFUND FROM LOCAL SERVICES TAX A copy of this application for a refund of the Local Services Tax LST and all necessary supporting KVJTLUZ TZ IL JVTWSLLK HUK WYLZLULK V OL H_ 6MÄJL OPZ HWWSPJHPVU MVY H YLMUK VM OL 3VJHS LYPJLZ H_ TZ IL ZPNULK HUK KHLK.

We offer user-friendly online services coupled with responsive customer support to 900 school districts and municipalities throughout Pennsylvania. Attach copys of final pay statements from employers. Make refund payable and mail to the representative.

PA DEPARTMENT OF REVENUE. The Local Services Tax is a local tax payable by all individuals who hold a job or profession within a taxing jurisdiction imposing the tax. Then you may complete a Local Services Tax Refund Application with acceptable proof of payments.

3131 COLONIAL DRIVE DUNCANSVILLE PA 16635. ¾ No refund will be approved until proper documents have been received. Two separate employers who are located in Pittsburgh withheld the Local Services Tax from the same employee.

Tax Day is Monday April 18 2022. Cumberland County Tax Bureau for approval. You will want to print or save the report generated by the Address Search Application for future reference.

Factories warehouses branches offices and residences of home-based employees. What happens if the income of an individual who filed an upfront Application for Exemption from Local Services Tax later exceeds the 12000 threshold during the calendar year. This is the date when the taxpayer is liable for the new tax rate.

Please allow four to six weeks for processing of your. For more information on myPATH visit revenuepagovmypathinformation. PO Box 559 Irwin PA 15642 Form LST22r21 LocaL ServiceS Tax refund appLicaTion Name Address CityState Zip Tax Year SSN Phone Multiple Employers Income exemption for Local Services Tax is 12000 or less from all sources of earned income and net profits when the LST tax rate exceeds 10 per year.

Your application for the refund of the Local Services Tax must be signed dated and presented to the. Request a Police Report. No refund will be approved until proper documents have been received.

Taxpayer Application for Refund of Local Services Tax LST - PA Department of Community Economic Development. The Department of Revenue e-Services has been retired and replaced by myPATH. A copy of this application for a refund of the Local Services Tax LST and all necessary supporting documents must be completed and presented to the tax office charged with collecting the Local Services.

Dunmore PA 18512 Call us on. Check complete where necessary the item number below that pertains to your refund request. ¾ A copy of this application for a refund of the Local Services Tax LST and all necessary supporting documents must be completed and presented to the tax office charged with collecting the Local Services Tax.

Telephone 717 590-7997 Fax 717 590-7998. Employers with worksites located in Pennsylvania are required to withhold and remit the local Earned Income Tax EIT and Local Services Tax LST on behalf of their employees working in PA. No refund will be approved until proper documentation has been received.

Use the Address Search Application to lookup PSD Codes EIT Rates and LST Rates. Lancaster PA 17601 717 569-4521 LOCAL SERVICES TAX REFUND APPLICATION for use where the Bureau collects LST _____ Tax Year This application for a refund of the Local Services Tax and all necessary supporting documents must be completed signed and presented to the Bureau. This application for a refund of the Local Services Tax must be signed and dated.

Ad Download Or Email PA REV-181 More Fillable Forms Register and Subscribe Now. Download File Taxpayer Application for Refund of Local Services Tax LST. Keystone offices will be closed on Friday April 15 in observance of Good Friday.

Local Services Tax for Tax Year. Low-Income Pennsylvanians May Be Missing Out on PA Tax Refunds of 100 or More. Click PayFile to access our.

No refund will be approved until. The name of the tax is changed to the Local Services Tax LST. For more information refer to the Application for Exemption from Local Services Tax and the Application for Refund from Local Services Tax.

Whether you are a taxpayer making a payment or a. If the total LST rate enacted exceeds 1000 the tax will be deducted at a rate of 100 per week. Follow the four 4 steps outlined below in order to comply with local income tax requirements as an employer in PA.

Refer to SCHEDULE I on the back of this form. Item numbers 1-4 below result in a refund of both municipal school portions of the tax where applicable. It is due quarterly on a prorated basis determined by the number of pay periods for a calendar year.

Item number 5 often results in a refund of only the municipal portion of an LST. BUREAU OF INDIVIDUAL TAXES. Local Services Tax LST Act 7 of 2007 amends the Local Tax Enabling Act Act 511 of 1965 to make the following major changes to the Emergency and Municipal Service Tax EMST Name Change.

Application for Refund Procedure. If you would like to report a tax. ¾ This application for a refund of the Local Services Tax must be signed and dated.

APPLICATION FOR REFUND FROM LOCAL SERVICES TAX. Making tax collection efficient and easy for over 35 years. Refund Application for Local Services Tax.

First fill out an Exemption Certificate with the employer that you earn the least with Secondary Employer. Lookup PSD Codes and Tax Rates. To find the status of your refund please visit.

Examples of business worksites include but are not limited to. A copy of this application for a refund of the Local Services Tax LST and all necessary supporting documents must be completed and presented to the tax office charged with collecting the Local Services Tax. July 10 2019July 10.

Home Refund Application for Local Services Tax. MyPATH functionality will include services for filing and paying Personal Income Tax including remitting correspondence and documentation to the department electronically. RICHARD WEBER Treasurer PHONE.

MAIL COMPLETED APPLICATION AND DOCUMENTATION TO.

Where S My Refund Eyewitness News

How To Get Maximum Tax Refund If You File Taxes Yourself

Taxes Work Travel Usa Interexchange

Deciding Where To Retire Affects Both Your Lifestyle And Your Wallet During Retirement Part Of Successfully Planning Your Tax Deductions Tax Refund Tax Return

Tax Refund Status Delayed Refunds Inflation Could Help Boost Your Return Abc7 Chicago

Where S My State Refund Track Your Refund In Every State

Avoid 6 Mistakes That Will Delay Your Irs Tax Refund

Tax Statement Form Seven Things You Should Do In Tax Statement Form Fillable Forms W2 Forms Excel Templates

Irs Starts Sending Tax Refunds To Those Who Overpaid On Unemployment Benefits Cbs News

California Tax Forms H R Block

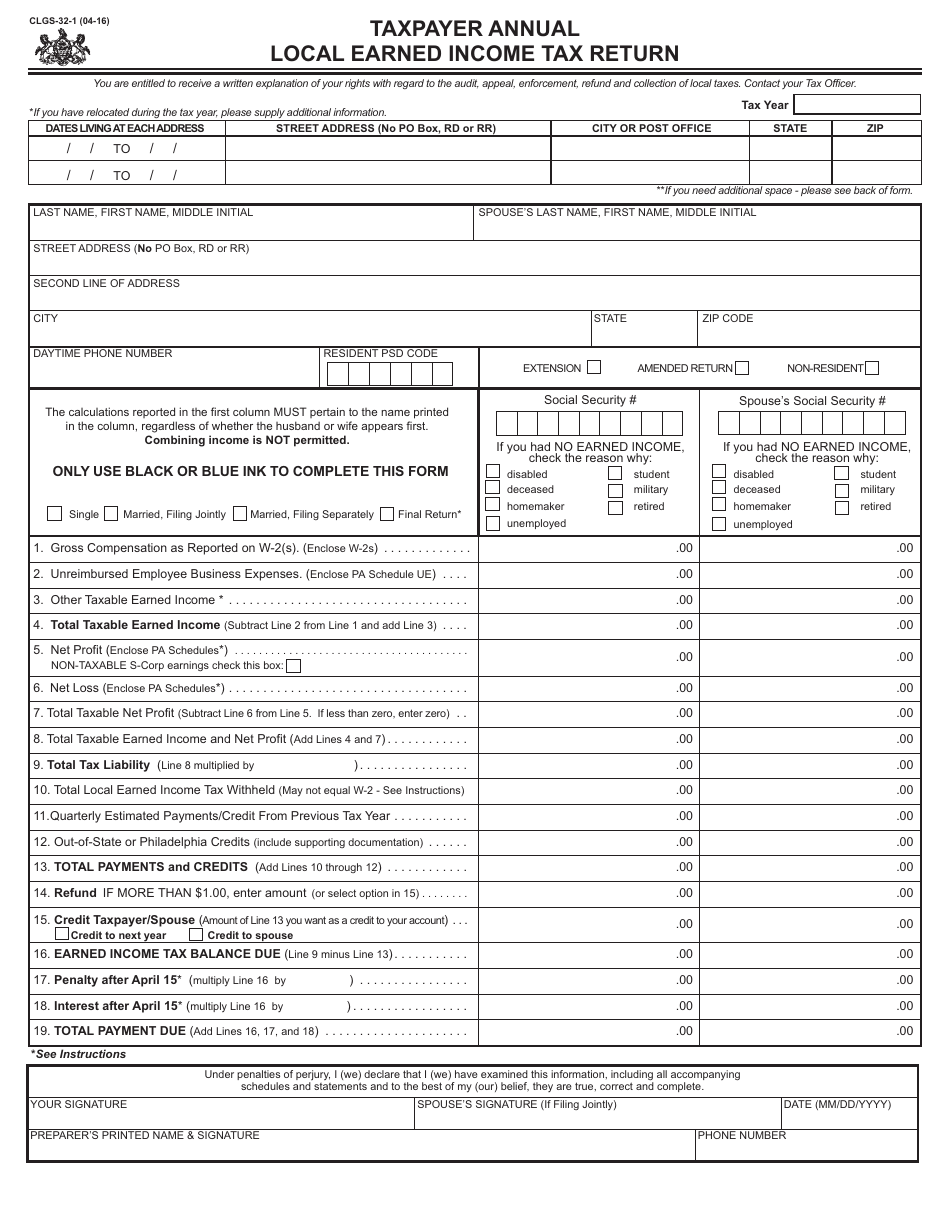

Form Clgs 32 1 Download Fillable Pdf Or Fill Online Taxpayer Annual Local Earned Income Tax Return Pennsylvania Templateroller

Still Waiting On Your Tax Refund Here Are Some Options For You Cbs 17

Faqs On Tax Returns And The Coronavirus

Do You Need To File A Tax Return In 2018

Is There A Delay For 2022 Tax Refunds Because The Irs Is Behind On Processing Tax Returns Latest News And Updates Aving To Invest

Apply My Tax Refund To Next Year S Taxes H R Block

What To Do If You Receive A Missing Tax Return Notice From The Irs